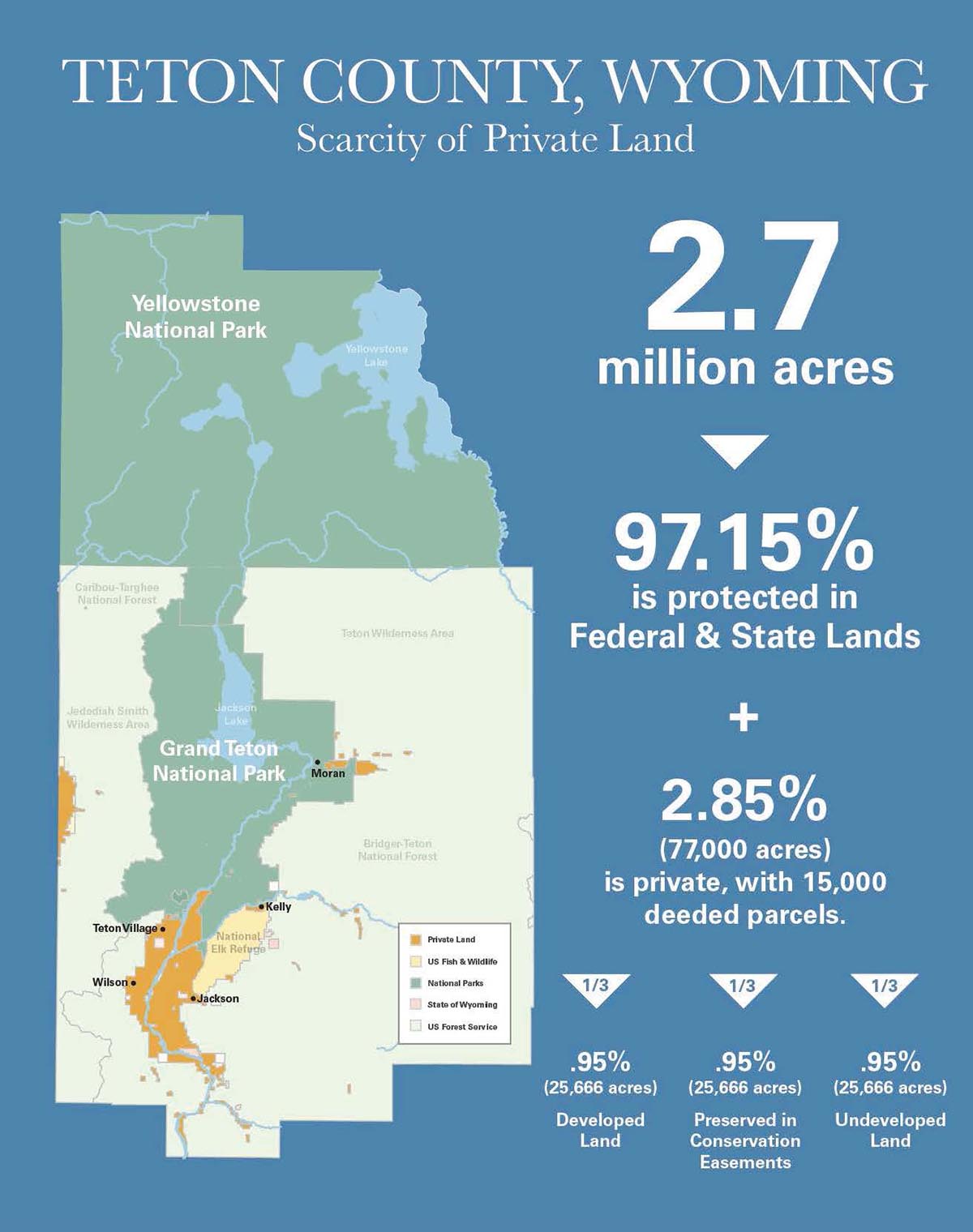

Why is Jackson Hole so expensive – it’s the real estate. Today, thanks to a century-old legacy of conservation and philanthropy, a large proportion of open space remains undeveloped in Jackson Hole. Private land is scarce here because more than 97 percent of the land in Teton County (the county in which Jackson Hole lies) is federally owned or managed by the state.

Of the 3 percent remaining in private ownership, amounting to about 77,000 acres, the Jackson Hole Land Trust alone protects almost 25,000 acres. Additional protections limit development in critical wildlife habitat like the river bottoms.

This leaves only about 2 percent of the land available for human development.

Grand Teton and Yellowstone national parks make up a large portion of the federally protected land in Jackson Hole. Around 40 percent of Yellowstone’s 2.2 million acres and all of Grand Teton National Park’s 310,000 acres are in the county. Grand Teton National Park also offers 200 miles of hiking trails.

In addition to the national parks, Jackson Hole includes state lands, portions of three national forests, one national wildlife refuge, Bureau of Land Management holdings and private and tribal lands.

All this leads to the simple fact of a scarcity of private land is driving the cost higher and higher as demand for those wanting to live in Jackson Hole outstrips supply making real estate values more and more expensive.

Demand is additionally fueled by the fact Wyoming offers a bonus as a tax haven for those seeking a Rocky Mountain lifestyle over other western states.

In 2019, Kiplinger rated Wyoming the #1 Most Tax-Friendly State, and Bloomberg Wealth Manager called Wyoming the most wealth-friendly state.

Why? It has some of the lowest property and sales taxes in America and no income taxes, estate taxes, no taxes on gas and groceries, no taxes on financial assets (including stocks and bonds), no taxes on the sale or gift of real estate and no taxes on out-of-state retirement income, which makes it extremely friendly for those who want to pass down their wealth. In addition to all of the tax benefits above, dynasty trusts shield real estate from federal estate taxes for up to 1,000 years. (Read more on Wyoming Tax Benefits.)

The cost of real estate drives pricing, not only for a place to live, whether you rent or buy, but what you’ll pay for goods and services. The businesses have to pass along their lease and labor costs in their pricing, which amounts to why Jackson Hole is so expensive.

While it’s not unusual to pay more to live in great places, we are actually fortunate that the limit of available private land will protect Jackson Hole into the future. There is a price for everything and Jackson Hole chose conservation.

Additional reading, Jackson Hole Building Costs: Everything You Need to Know