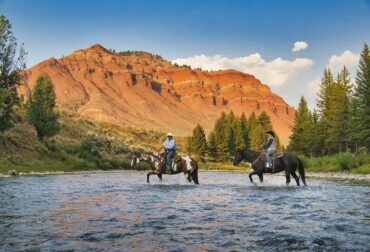

Pitchfork Ranch, Wyoming

Not many people get the chance to reflect on how policies intersect with property — but recently, I had the opportunity. I was honored to be featured in a Realtor.com article titled “Tax on the Range: How Luxury Ranches Are Taxed.” (Realtor.com Article) It’s an exploration of the unusual juncture where high-end real estate meets agricultural tax law — and I thought it would make for a great story to share with you, my readers, from my own perspective.

A Peek Behind the Article

The Realtor article dives into a somewhat surprising reality: many luxury ranch properties — even those boasting sweeping views, custom homes, and high-end amenities — are often taxed under agricultural (ag/farm) rules, not standard residential rules. This can lead to significantly lower tax bills for owners.

Why? Because in many jurisdictions, land that’s classified for agricultural use is valued (for tax purposes) based on its productive use (e.g. grazing, farming) rather than on market value. The structures (homes, barns) are still taxed on their market value, but the underlying land may get a favorable discount.

The article explores how these rules work, who benefits, and what reforms might be on the horizon, especially as some critics question whether high-end owners are leveraging rules intended for working farms.

What It Was Like To Be Interviewed

Personally, being interviewed for this piece forced me to confront assumptions about property ownership, taxation, and fairness. During the interview, I emphasized that owning a luxury ranch isn’t just about romantic notions of wide-open landscapes — there’s a serious business side:

- Operational Costs: It’s not just the house; there are fences, roads, water access, maintenance of pasture or grazing land, and infrastructure such as barns, irrigation, and staff facilities.

- Intent vs. Usage: One can’t just call a property “agricultural” for tax benefit — in many places you have to show some agriculture or ranching activity (even if minimal) to demonstrate qualifying usage.

- Changing Laws & Risk: Some states are reconsidering or tightening their tax rules, especially in places where residential or luxury properties are benefitting from agricultural classification.

In that way, the feature was not just about me — it was a chance to bring light to wider trends facing ranch owners, policy makers, and rural communities.

Lessons & Takeaways for Ranch Owners (or Aspirants)

If you’re considering a luxury ranch — or already own one — here are a few lessons I’d pass along (some of which I shared in the article):

- Understand local rules deeply. The definition of “agricultural land use” differs vastly by county, state, or even township. What qualifies in one place might not in another.

- Document your usage. Even if your ranch is mostly a retreat, try to demonstrate some agricultural activity (grazing, hay production, lease to livestock, etc.) — this can solidify your case under ag rules.

- Budget for surprises. Favorable tax treatment might shift, especially if political winds change. Always plan for changes in tax law or reassessments.

- Balance lifestyle with investment. A ranch is often more than a home — it can be an asset, a legacy, and yes, a tax strategy. But relying too heavily on favorable tax treatment without understanding the risks is perilous.

- Stay informed and engaged. As the Realtor article shows, these rules are under scrutiny in many places. As a ranch owner, your voice and understanding matter when policy evolves.

Why I’m Sharing This Story

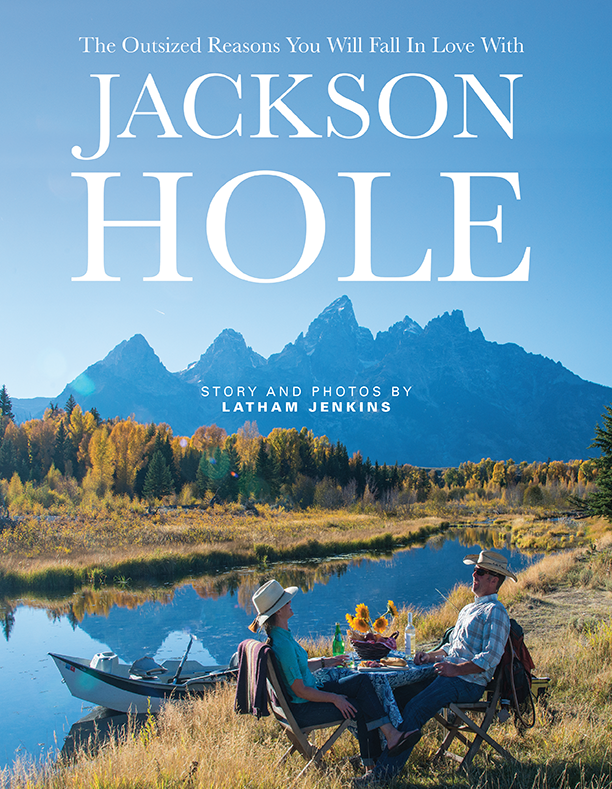

When I was asked to speak about this topic, the decision wasn’t just about credibility or exposure — it was a rare chance to share insight with people who might one day stand where I do. A ranch is a powerful blend of land, lifestyle, legacy, and financial reality.

I hope that by telling the story behind the article, you’ll see more clearly what goes on behind the scenes of ranch ownership — the joys, the challenges, and yes, the tax complexities.

###