Introduction

From Silicon Valley tech founders to Wall Street hedge fund managers, a quiet migration is reshaping the Mountain West. Wyoming, long known for its rugged terrain and cowboy ethos, is now attracting high-net-worth individuals seeking something more enduring: privacy, tax efficiency, and legacy ownership of the American West.

Here’s why ultra-wealthy buyers are choosing Wyoming—and what they’re getting in return.

1. A State with No State Income Tax—Backed by Constitution

Wyoming’s zero income tax is more than a budget-line benefit—it’s a lifestyle choice for wealth preservation. Unlike other tax-friendly states, Wyoming constitutionally prohibits income taxation, offering unmatched long-term certainty.

Additionally:

- No capital gains tax

- No tax on out-of-state retirement income

- No state estate or inheritance tax

For individuals managing complex portfolios, family offices, or dynasty trusts, Wyoming provides legal and financial stability few states can match.

2. The Power of the 100-Year Dynasty Trust

Wealth preservation across generations is easier in Wyoming thanks to its 100-year dynasty trust laws. These trusts allow families to hold real estate and other appreciating assets outside of estate tax exposure for up to a century.

Buyers often structure ranch purchases through a Wyoming dynasty trust to:

- Pass land to heirs with minimal tax burden

- Protect the property from creditors or litigation

- Keep ownership private through LLC layering

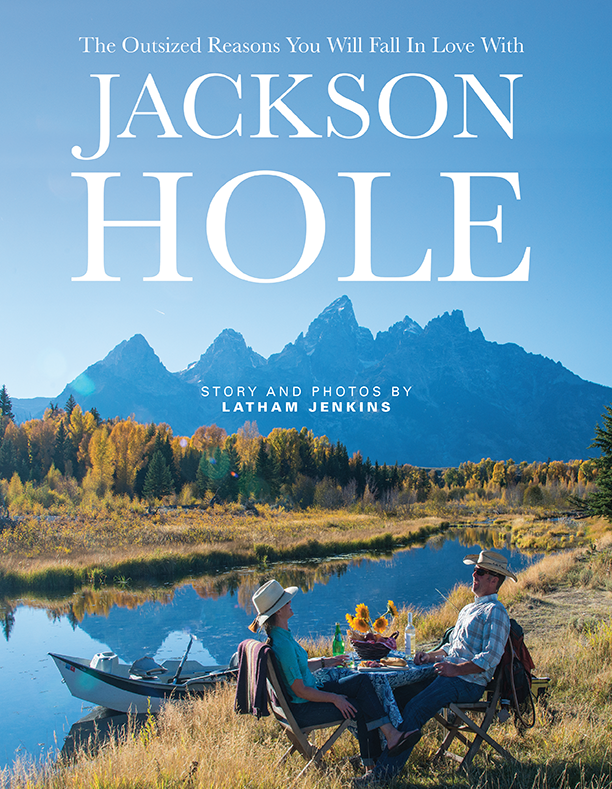

3. Landscape as Legacy: Owning the West

For many high-net-worth buyers, a Wyoming ranch is more than land—it’s a legacy asset.

These properties offer:

- Thousands of acres with trophy hunting, world-class fly fishing, and horseback riding

- Direct access to public lands and wilderness corridor

- Conservation potential with federal and state tax incentives

Whether it’s a working cattle ranch or a private retreat near Jackson Hole, Wyoming offers something that can’t be replicated: unspoiled terrain, generational value, and an authentic Western identity.

4. The Rise of Lifestyle-Driven Investing

Post-pandemic, UHNW buyers are prioritizing:

- Safe, private destinations with access to recreation

- Healthy, nature-based living

- Multi-use properties that serve as second homes, retreats, and income-generating ranches

Wyoming ranches meet all three—and often come with entitlements for guest cabins, lodges, or event venues. They’re not just lifestyle purchases—they’re flexible assets with upside.

5. A Quiet, Sophisticated Community

Wyoming offers a low-density, high-security lifestyle with increasing sophistication:

- Private aviation access near towns like Jackson, Alpine, and Sheridan

- Access to elite schools, healthcare, and cultural events

- Close-knit communities with discretion and stewardship values

For those escaping the spotlight—or just seeking room to breathe—Wyoming offers privacy without sacrificing access.

6. Conservation Easements: Save Land, Save Taxes

Many buyers are leveraging conservation easements to permanently protect scenic land and receive substantial federal income tax deductions—sometimes offsetting 40–50% of the purchase price over time.

The Tax Cuts and Jobs Act of 2017 made these benefits even more powerful by allowing:

- 100% bonus depreciation on eligible improvements

- 15-year carry-forward of deductions on conservation donations

Properly structured, this can dramatically reduce effective land costs, especially for active W-2 income earners or those with large capital events.

Frequently Asked Questions

Q: What is the minimum ranch price point that benefits from Wyoming tax advantages?

A: Most strategies show significant return on purchases above $10M, with optimal benefits often realized at $25M+ due to trust structuring and conservation leverage.

Q: Can I live elsewhere and still use a Wyoming dynasty trust?

A: Yes. You don’t need to live in Wyoming to hold assets there—you only need a Wyoming trustee.

Q: Are conservation easements reversible?

A: No. They are permanent legal agreements, which is why they’re attractive to buyers interested in legacy stewardship.

Final Thought: Wyoming Is Not Just a Tax Shelter—It’s a Statement

Choosing Wyoming is more than financial engineering. It’s about owning land with meaning, building something for generations, and stewarding a part of the American West.

For high-net-worth families and forward-thinking investors, it’s not just where the taxes are lowest—it’s where the values run deepest.